17 May 2018

Monetary policy comes full circle in 2018 (Livemint)

The year 2018 is significant for two developments in monetary economics.

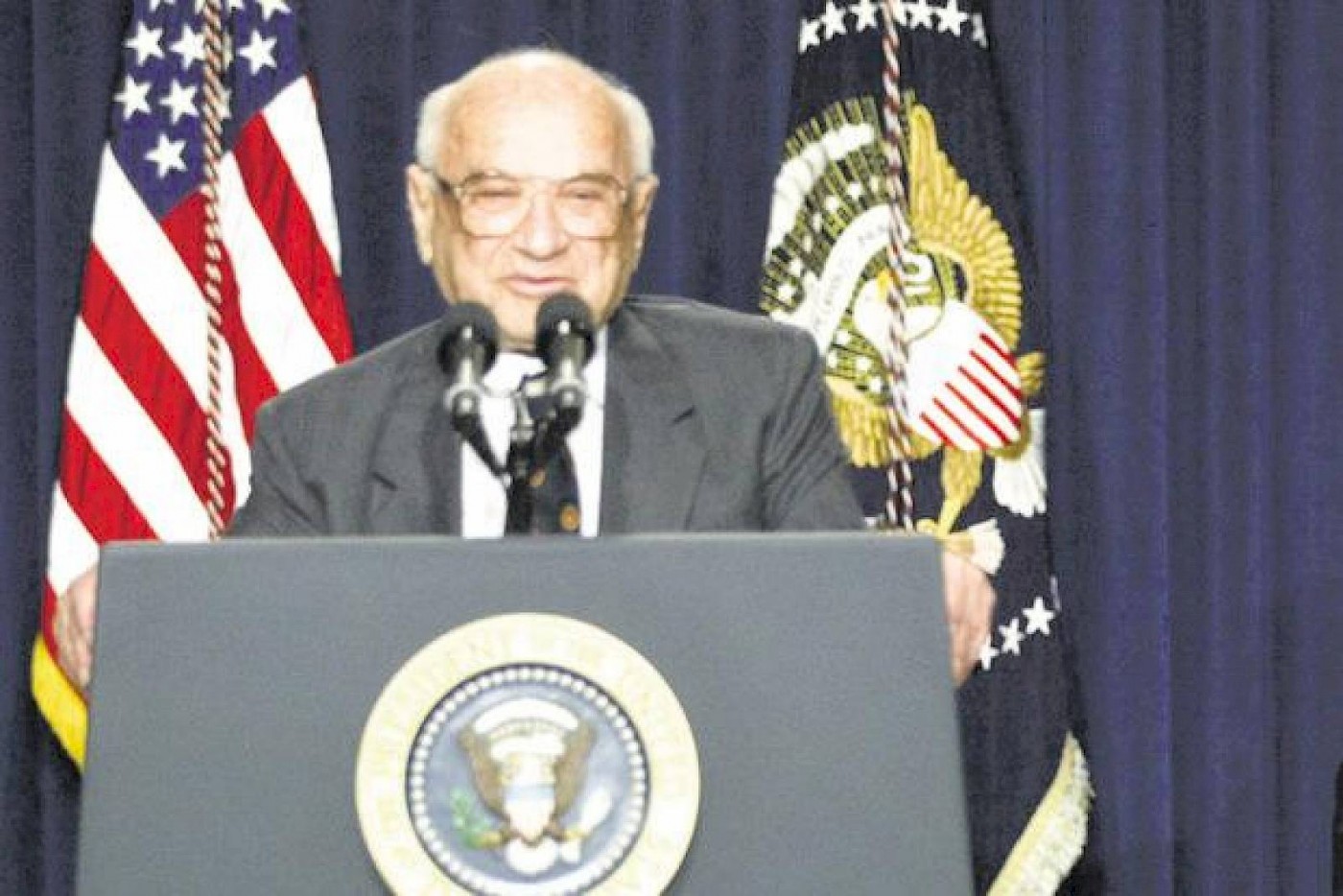

First, this year marks the 50th anniversary of Milton Friedman’s landmark lecture titled “The role of monetary policy". Before the lecture, the Phillips curve, which showed that there was a trade-off between inflation and unemployment, dominated policy thinking. Thus, the policy could be tinkered to achieve the desired objectives—lower unemployment and higher inflation, or vice versa.

Friedman instead argued that monetary policy can only impact nominal variables, such as prices, and not real variables such as the gross domestic product and employment. The so-called trade-off was only for the short run, and any tinkering would result in higher inflation over the long run. Thus, he argued, the central banks should focus on inflation—something that turned the accepted wisdom on its head. That the lecture continues to be celebrated shows the remarkable longevity of his ideas. In the history of economic thought, Friedman’s arguments were not new. It was both the timing of the lecture—when both inflation and unemployment were rising—and Friedman’s oratory skills which contributed to making his lecture iconic.

Read the original article here